20 year mortgage refinance calculator

If the down payment is less than 20. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR.

. While both loan types have similar interest rate profiles the 20-year loan typically offers a slightly lower rate to the 30-year loan. Build home equity much faster. 20 year refinance rates.

If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. Use our mortgage refinance calculator to get an idea of how much it will cost. 30-Year Fixed Rate Mortgage - A home loan paid over a term of 30 years.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

It will have a lower monthly payment but a. You will need to either renew or refinance your mortgage at the end of each term. The average amount of days it took to close a home refinance was up year-over-year in 2020.

Account for interest rates and break down payments in an easy to use amortization schedule. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Here are some of the common loan terms entered into the calculator.

10-year fixed mortgage rates. The average 20-year refinance APR is 6150 according to Bankrates latest survey of the nations largest mortgage lenders. This mortgage calculator uses the most popular mortgage terms in Canada.

People typically move homes or refinance about every 5 to 7 years. During the draw period monthly payments of accrued interest are required. At Bankrate we strive to help you make smarter financial decisions.

529 State Tax Calculator Learning Quest 529 Plan. If a person. BMO allows you to increase your regular mortgage payments by up to 20 once per calendar year.

The one-year two-year three-year four-year five-year and seven-year mortgage terms. For down payments of less than 20 home buyers are required to purchase mortgage default insurance commonly referred to as CMHC insurance. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

The above calculator is for fixed-rate mortgages. Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. 30-Year Refinance Rates.

Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage. But if you earned significantly more in one year than the other the lender may opt for the years average with lower earnings. Estimated monthly payment and APR calculation are based on down payment of 20 and borrower-paid finance charges of 0862 of the base loan amount.

The minimum down payment in Canada is 5. The loan program you choose can affect the interest rate and total monthly payment amount. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate.

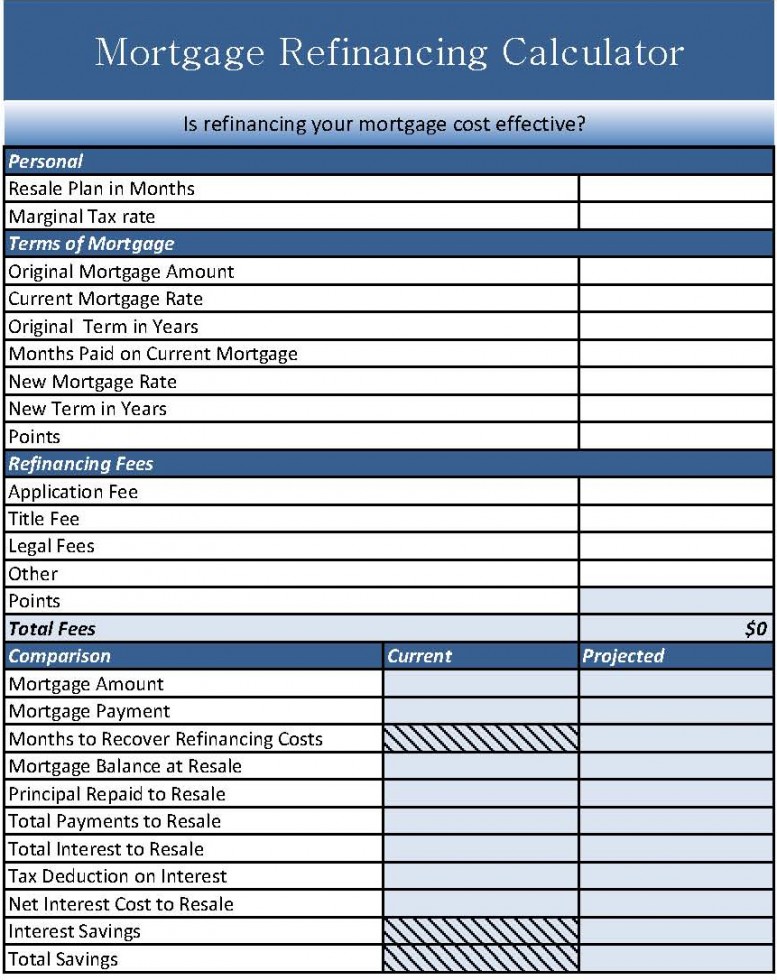

Learn more about mortgage refinancing. Historical 30-YR Mortgage Rates. Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs.

Should I refinance to a 20-year or 30-year mortgage. Down payment The amount of money you pay up front to obtain a mortgage. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

You will only need to pay for mortgage insurance if you make a down. As for payment terms the most common ones are 30-year terms. The most common home loan term in the US is the 30-year fixed rate mortgage.

Learn how much it costs to refinance with US. 15-year fixed mortgage rates. Refinancing your mortgage can be a really valuable option.

10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Higher credit scores tend to be rewarded with lower PMI payments as well.

Our mortgage refinance cost calculator helps you determine the cost to refinance your mortgage. This allows you to secure a lower rate and pay your mortgage earlier. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

5750 down from 5875 -0125. The loan is secured on the borrowers property through a process. Todays national mortgage rate trends.

15-Year Fixed Rate Mortgage - A home loan paid over a term of 15 years. It will have a higher monthly payment but a lower interest rate than a 30-year mortgage. This is because loans with longer terms come with cheaper monthly payments.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. 10 year refinance rates.

But you may also obtain 20-year 15-year and 10-year terms. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. 15 year refinance rates.

Use our free mortgage calculator to estimate your monthly mortgage payments. Refinance rates valid as of 31 Aug 2022 0919 am. Shorter term loans such as 15-year fixed or 10-year fixed tend to have much lower PMI payments than longer-term loans like the 20-year or 30-year fixed.

2 days ago20-year fixed mortgage rates. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Refinancing to a 20-year mortgage will cost less interest over the life of the loan than a 30-year mortgage of the same amount.

You can choose to refinance your home mortgage when looking to lower your monthly payments or pay off your loan sooner. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

But monthly payments are higher for 20-year loans. Home equity lines have a 10year draw period followed by a 20year repayment period. Rates last updated on September 6.

A mortgage in itself is not a debt it is the lenders security for a debt.

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Amortization Schedule Mortgage Calculator Mortgage Rates

Mortgage Refinance Calculator Excel Spreadsheet

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Mortgage Calculator Mortgage Calculator Home Mortgage Calculator Templates 13 Free Docs Xlsx Mortgage Payoff Pay Off Mortgage Early Mortgage Loan Calculator

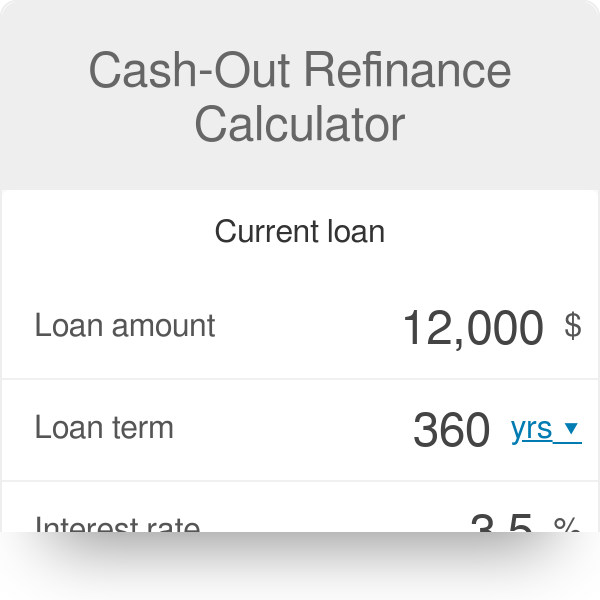

Cash Out Refinance Calculator

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payment Calculator For Excel Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Refinance Calculator

Loan Amortization Schedule In Excel Amortization Schedule Interest Calculator Excel Tutorials

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Komentar

Posting Komentar